However, if they aren’t able to help you, then you can ask to be transferred to a new expert. Your tax return is securely submitted directly to the CRA with just one click. You’ll get your refund fast – in as few as 8 business days. The desktop version of TurboTax is typically cheaper than TurboTax online. However, not every computer and operating system supports TurboTax desktop. The desktop version is also updated less often than the online version, so it may feel more clunky and less intuitive.

TaxAct is another alternative to TurboTax that offers many online and offline software options to choose from. In addition to different plans for personal tax returns, it also offers bundle pricing for other business structures, such as partnerships and S corporations, which may be appealing to small-business owners. Live tax advice can be added to any pricing plan, including the free plan, for $39.99. TaxAct also guarantees a bigger refund than any other tax software currently on the market.

Easily and accurately file your simple tax returns for FREE.

They will educate you about what to expect, and how to prepare for an audit, but they won’t actually represent you in front of the IRS. Audit defense is included in both of the business plans, and it can also be added on to the personal plans for an additional fee. With audit defense, you get full audit representation by a licensed tax professional, including representation in front of the IRS. In this guide, we investigate TurboTax’s pricing plans and break down its pros and cons to help you decide if TurboTax is the right tax filing software for your needs. TurboTax is the most popular tax filing software in the United States.

For this reason, many taxpayers still find that TurboTax is worth the price tag — but there are plenty of more affordable TurboTax competitors if you want to explore other options. You’ll only need your email address and a phone number to get started. Eventually, for more complex tax situations, you may need additional documents like mortgage statements or other detailed financial information. But since we save your return as you go, you can finish anytime.

How TurboTax works

Your personal information, such as your Social Security number, will also be obscured so the tax expert can’t see it when you share your in-progress return with them. We offer free one-on-one audit guidance year-round from our experienced and knowledgeable tax staff. 100% accurate calculations, audit support, and your max refund. Your tax files end in .tax or .tax2020 or .tax2021 or .tax2022 etc. They should be in your Documents in a Turbo Tax folder. TurboTax online is very well designed and easy to use, and the interface is intuitive to navigate. The questionnaire-based, step-by-step guide also simplifies the DIY tax filing process.

PT from the January date the IRS starts accepting tax returns through the April filing deadline. From mid-April through early January, they’re available Monday through Friday from 5 a.m. You can share your TurboTax screen with the tax expert, but you cannot share any other tax documents with them, which can be quite limiting, depending on the complexity of your situation.

FULL SERVICE GUARANTEE

There are a few options for you to fix this, depending on the situation. Note that this service is completely virtual, as TurboTax does not have physical office locations like its main competitor H&R Block. However, you may potentially have the option to choose an independent TurboTax Verified Pro, which are independent tax professionals who are vetted by TurboTax and offer the ability to meet in person. See when your return is accepted and when you can expect your refund.

- H&R Block is the closest competitor to TurboTax, offering many of the same features.

- In addition to different plans for personal tax returns, it also offers bundle pricing for other business structures, such as partnerships and S corporations, which may be appealing to small-business owners.

- This plan starts at $129 to file federal returns, with $69 for each state return.

- Audit defense is also included in this plan, which is available in all 50 states.

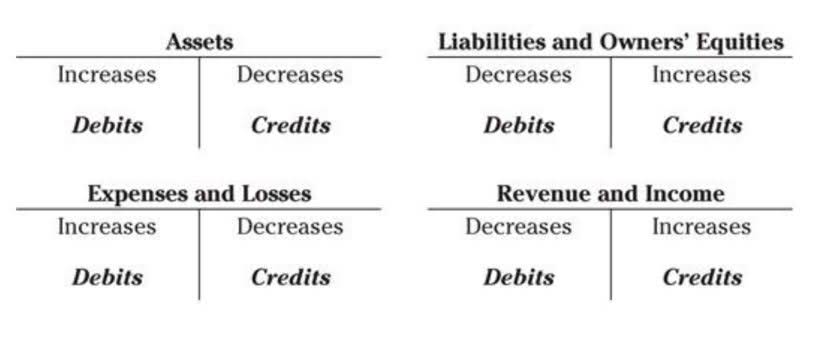

If you use an accrual method of accounting, you normally report income as you earn it. H&R Block is TurboTax’s closest competitor, but it offers several advantages over TurboTax, including cheaper pricing plans and the option to get my turbotax login in-person assistance at an H&R Block office. When you access Live Assisted help, you’ll enter some information about your question, then TurboTax will connect you with someone who should understand your specific tax situation.

Do you have an Intuit account?

All features, services, support, prices, offers, terms and conditions are subject to change without notice. To review TurboTax, we signed up for the free version of its tax software. We also consulted user reviews and product documentation during the writing of this review. We weighed factors such as pricing, expert advice, live assistance and user interface design when evaluating TurboTax. The Federal Trade Commission issued an opinion that TurboTax previously engaged in deceptive advertising, promoting “free” tax services to consumers that were ineligible for it. TurboTax made it seem as if all or most consumers were eligible to file free federal and state returns, when in actuality only a small minority of people qualify for the free version.

This can be accessed by clicking on the “Live Assist” button in the upper right-hand corner of the interface. First, you’ll put in your personal information, such as your full name and Social Security number, then you’ll fill out your federal tax return using information from your W-2 or 1099 forms. After you’re finished with the federal return, you’ll be prompted to create a state return, if applicable.